Build your Goals

EasyAssetManagement’s wide range of portfolios ensures that your investments make sense for you, specifically.

Investing Is Personal

That’s why we keep humans in the picture to manage your money. We also create access, deliver strong returns and help educate you throughout your investment journey.

No matter the climate, we're here to guide you on your quest for financial greatness.

Why Choose EasyAssetManagement?

We’ve adopted a data-driven, algorithmic approach to investing that does not rely on human judgment and can be objectively tested and affirmed using historical data.

Our algorithmic data-driven asset management approach uses large amounts of data to train our algorithms to identify patterns and trends that can help to improve investment decision-making. This leads to better investment returns and reduced risk.

We understand that everyone has different risk appetites, so we offer a wide range of investment options to suit all needs. Whether you are a conservative investor who is looking for a low-risk investment with a steady return, or an aggressive investor who is willing to take on more risk for the potential of higher returns, we have an investment bundle for you.

How We Work

You set the goal, we’ll guide the way.

We use advanced algorithms to create custom portfolios for our clients, based on risk preference.

We combine both active and passive investing, responsive to market conditions.

We use building blocks to build our portfolios to deliver on specific investment goals.

We’re here to guide you. Transparency and education are important parts of the process.

Our Building Blocks

We know that conquering mountains requires a range of skills. That's why our portfolios are composed using various building blocks, carefully tailored to achieve specific investment goals while considering associated risks.

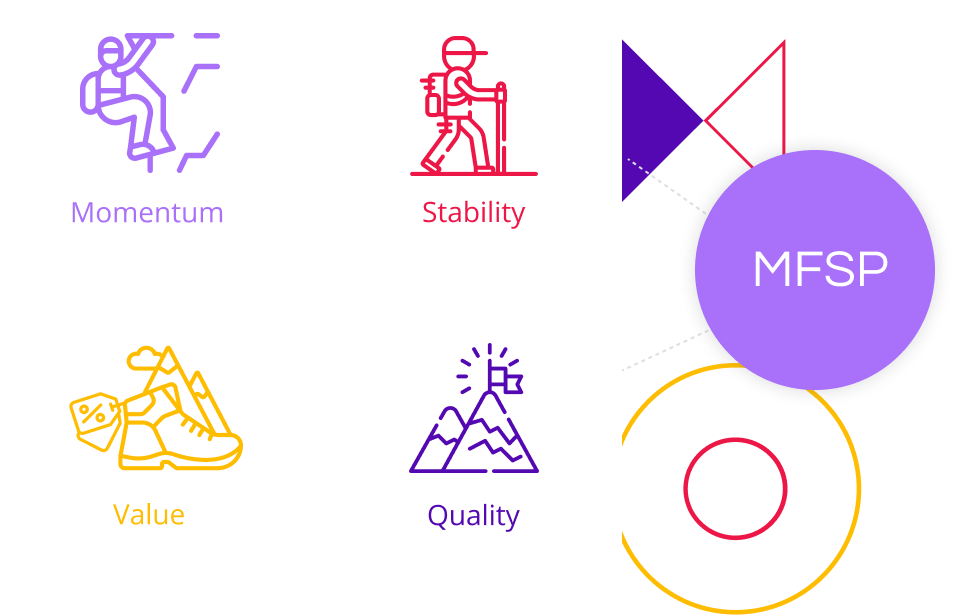

Value

Quality

Stability

Momentum

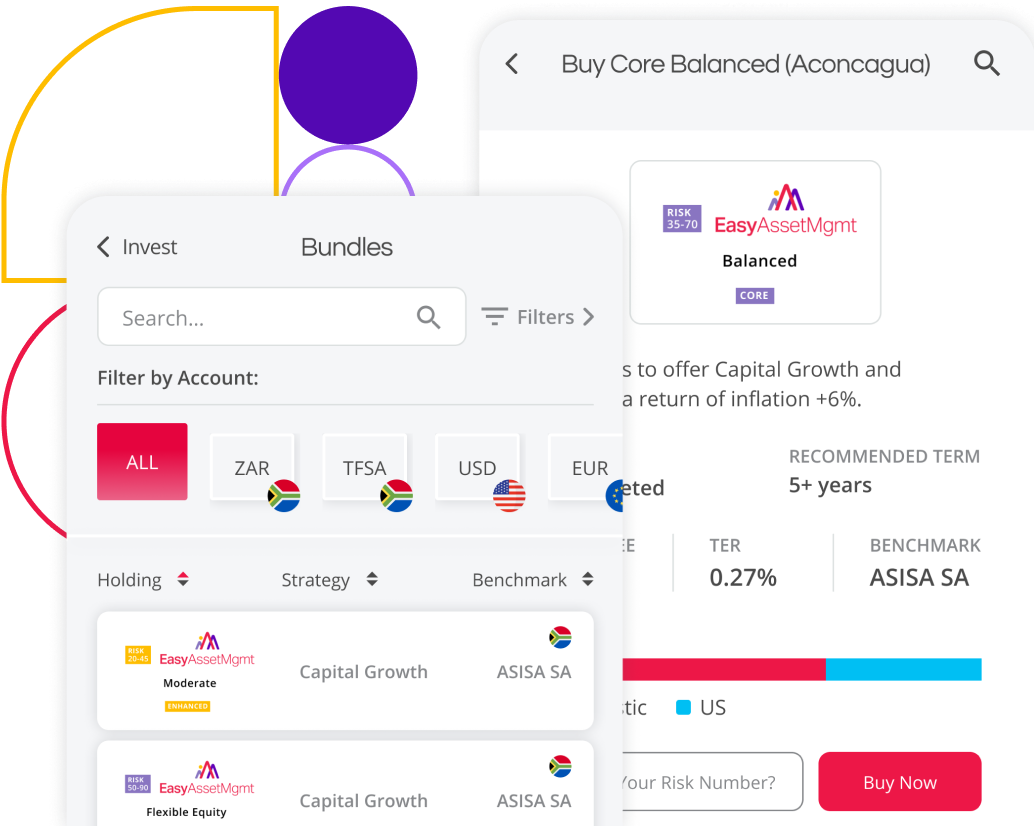

Investment Options

Our portfolios can be applied to various EasyAssetManagement accounts including a Tax Free Savings Account (TFSA), Retirement Annuity (RA), Unit Trust or Discretionary*.

*Discretionary accounts are those which don’t have the same restrictions that the others do, and can contain both equities and Exchange Traded Funds (ETFs).

MFSP

Managed Factor Share Portfolios (MFSP) - Building Blocks

Invest in one of our portfolios which uses a combination of these building blocks, or create your own portfolio by selecting and investing in the ones which align with your risk appetite and investment style. The intrepid adventurer knows that it doesn’t take just one skill to conquer a mountain. Having a few different building blocks helps diversify your portfolio, so that when conditions aren’t ideal in one area of the market, or mountain, you only catch a few drops instead of having to tread through a monsoon.

Each of the Core portfolios is associated with a risk range. The higher this number is, the more investment will be allocated higher-risk asset classes such as equity - with a corresponding increase in expected returns. Core portfolios are also available in RA and TFSA accounts and are constructed to comply with the investment criteria governing retirement funds (regulation 28) and TFSA funds respectively.

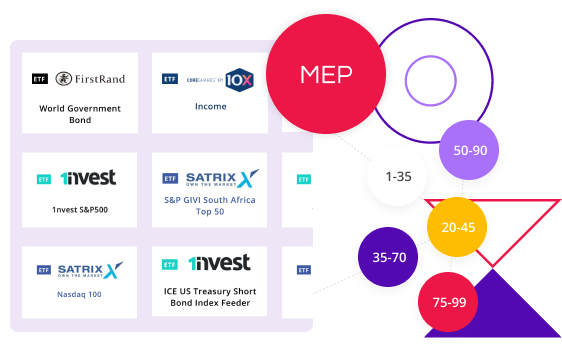

MEP

Managed ETF Portfolios (MEP) - Core

Core Managed ETF Portfolios cater to a range of risk profiles from conservative to aggressive. These portfolios blend a variety of asset classes: local cash, bonds, property, and both local and international equities and use only ETFs (Exchange Traded Funds) in their construction.

Like how we select assets for our building blocks, we use algorithms to allocate investments to each asset class with the goal to achieve a targeted risk and return outcome. Read More Like how we select assets for our building blocks, we use algorithms to allocate investments to each asset class with the goal to achieve a targeted risk and return outcome. Each of the Core portfolios is associated with a risk range. The higher this number is, the more investment will be allocated higher-risk asset classes such as equity - with a corresponding increase in expected returns.

Core portfolios are also available in RA and TFSA accounts and are constructed to comply with the investment criteria governing retirement funds (regulation 28) and TFSA funds respectively. Read Less

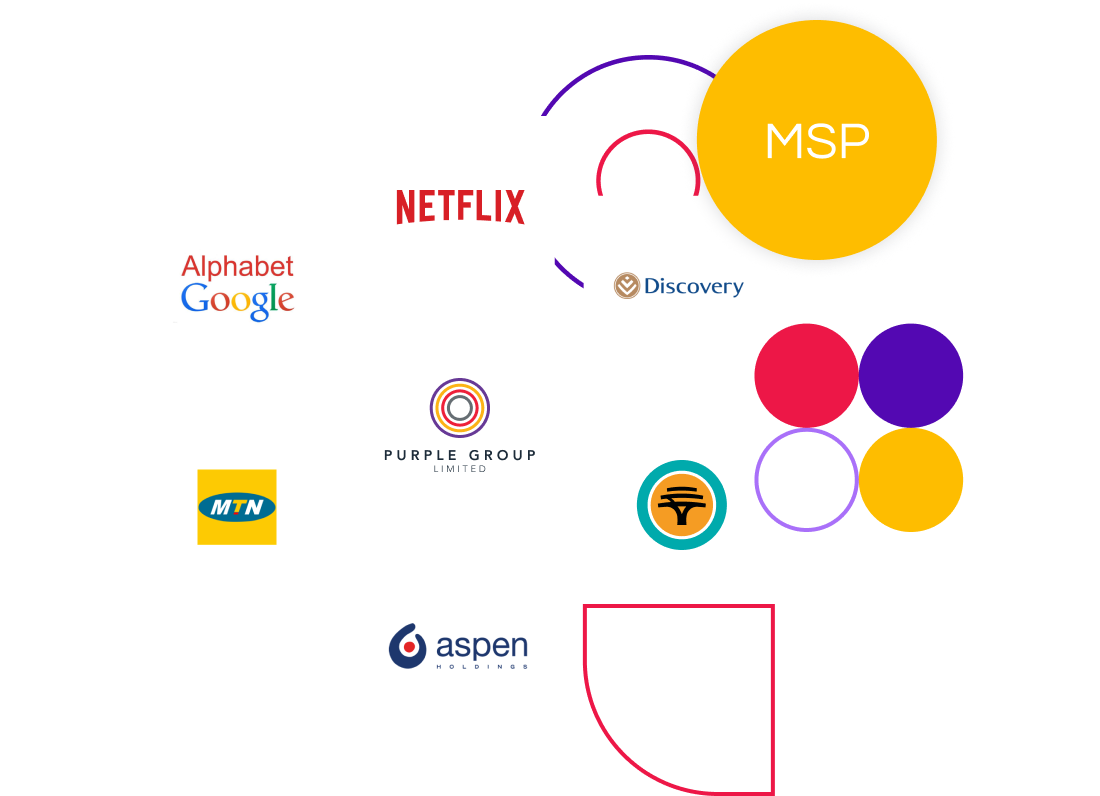

MSP

Managed Share Portfolios (MSP) - Enhanced

Our Managed Share Portfolios Enhanced Range offers pure equity portfolios for the more aggressive investor as well as enhanced variations of our Core range (risk targeted portfolios). Enhanced Portfolios cater to a range of risk profiles from conservative to aggressive. These portfolios offer a more sophisticated investment approach targeting returns in excess of, and risk that is similar to or less than, their selected benchmarks. Our algorithms analyse the relationship between risk factors over various economic and market cycles and invest in each of our equity building blocks, or variation thereof, based on that analysis. Enhanced portfolios are also available in RA accounts and are constructed to comply with the investment criteria governing retirement funds (Regulation 28).

MLP

Managed Leveraged Portfolios (MLP) - Alternative

Our leveraged equity portfolios are designed for the more sophisticated investor seeking strategy diversification and enhanced returns. Our algorithms analyse the relationship between risk factors over various economic and market cycles, and we invest in each of our equity factor building blocks based on that analysis. Through the use of derivative instruments, we are able to position the portfolios both long and short to maximise portfolio outcomes. Proprietary algorithms are utilized to determine optimal exposure levels and to facilitate sector and share weights, investment style and sector rotation to fully capture excess returns.

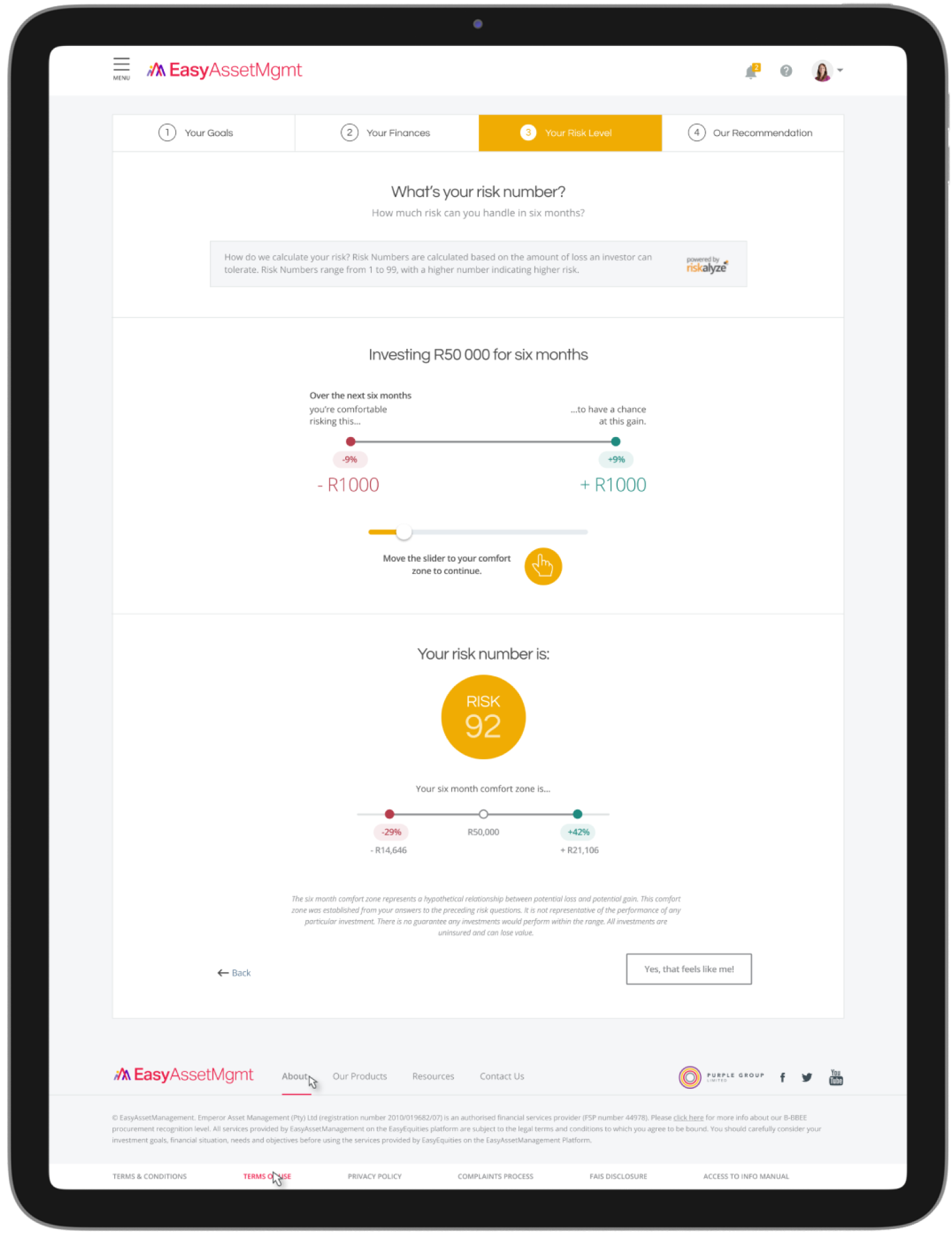

What’s Your Risk Number?

Calculate your risk number and we’ll help you match it to a portfolio.

Deciding on the right investment portfolio is a complex task and with a good number of variables to consider, many feel that it's beyond their capabilities to make a decision without the help of an investment advisor. Unfortunately, in many instances, advisers are ill-equipped to cater to the varying demands of the South African population and as a result, investment advice remains limited to a small portion of our people.

We have considered this and designed and partnered solutions, products and investment processes that recognise these failings. Allowing us to deliver a flavour of investments that works, just for you.